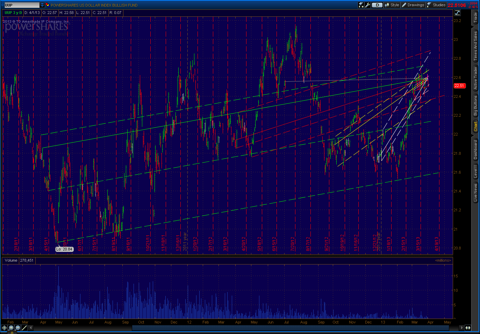

Dollar Pivots: Chart: UUP ETF: 3 YEAR DAILY OHLC With Key Focus EchoVectors And EchoBackDates And Coordinate Forecast EchoVectors: Monthly, Quarterly, Bi-Quarterly, Annual, And Semi-Annual.

PRECISION PIVOTS ECHOVECTORVEST MDPP MODEL OUTPUT CHART ILLUSTRATION AND HIGHLIGHTS COLOR CODE GUIDE

1. Regime Change Cycle EchoVector (8 Year, Week-to-Week): Long AquaBlue

2. Regime Change Cycle EchoVector (8 Year, Week-to-Week): Long Yellow

3. Regime Change Cycle EchoVector (8 Year, Week-to-Week): Long Pink

4. Presidential Cycle EchoVector (4 Year, Day-to-Day): Long White

5. Congressional Cycle EchoVector (2 Year, Day-to-Day): Green

6. Congressional Cycle EchoVector (2 Year, Day-to-Day): Blue Purple

7. Congressional Cycle EchoVector (2 Year, Day-to-Day): Long Pink

8. Annual Cycle EchoVector (1 Year, Day-to-Day): Red

9. Annual Cycle EchoVector (1 Year, Day-to-Day): Pink

10. Annual Cycle EchoVector (1 Year, Day-to-Day): Long Blue Purple (Pivot Indicative)

11. 9-Month Cycle EchoVector (9 Months, Day-to-Day): Grey

12. Bi-Quarterly Cycle EchoVector (6 Months, Day-to-Day): Yellow

13. Quarterly Cycle EchoVector (3 Months, Day-to-Day): White

14. Monthly Cycle EchoVector (1 Month, Day-to-Day): Peach

15. Weekly Cycle EchoVector (1 Week, Day-to-Day): Aqua Blue

16. Daily Cycle EchoVector (1 Day, Day-to-Day): Short Pink

17. Select Support or Resistance Vectors and/or Relative Price Extension Vectors (Various Lengths): Navy Blue

Space-Color Vector Highlights are Graphical Illustrations of Corresponding and Coordinate Color-Length-Slope MDPP Forecast Model Key Active Focus EchoVectors.

ECHOVECTORVEST MDPP PRECISION PIVOTS MODEL LOGICS:

Trend period echovector echo-period price point level.

Trend period echovector echo-period price point level pivot extension: equal.

Trend period echovector echo-period price point level pivot extension: stronger: potential echovector slope pivoting effect.

Trend period echovector echo-period price point level pivot extension: weaker: potential echovector slope pivoting effect.

Trend period echovector echo-period price point level REVERSAL: Counter-Echo Pattern: Trend period echovector slope pivoting.

EP: EchoPivot: Trend Timing and Price Vector and Period Corresponding Pivot.

EPCP: EchoPivot CounterPivotPivot: Trend Timing and Price Vector and Period CounterTrend Corresponding CounterPivot (Induces greater force-slope up, or weaker force-slope up, or greater force-slope down, or weaker force-slope down).

__________________________________________________________________________

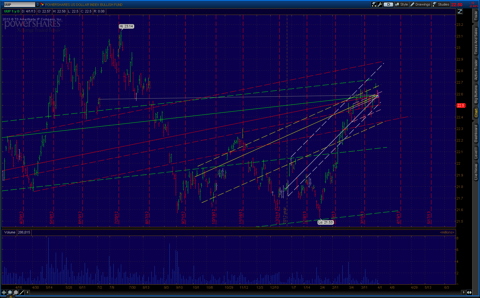

Tuesday, 2 April 2013

Dollar Pivots: Charts: UUP ETF: 25 Month Daily And 14 Month Daily OHLC With Key Focus EchoVectors And EchoBackDates And Coordinate Forecast EchoVectors: Weekly, Monthly, Quarterly, Bi-Quarterly, Annual, And Semi-Annual. [Edit or Delete]0 comments

Annual Cycle EchoVector (1 Year, Day-to-Day): Red

9-Month Cycle EchoVector (9 Months, Day-to-Day): Grey

Bi-Quarterly Cycle EchoVector (6 Months, Day-to-Day): Yellow

Quarterly Cycle EchoVector (3 Months, Day-to-Day): White

Monthly Cycle EchoVector (1 Month, Day-to-Day): Peach

Weekly Cycle EchoVector (1 Week, Day-to-Day): Blue

Daily Cycle EchoVector (1 Day, Day-to-Day) Pink